Technology enables us to keep your portfolio responsive to micro and macro-economic conditions

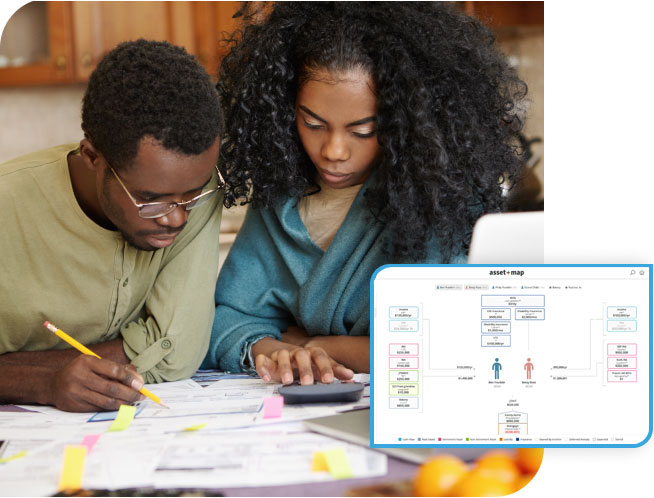

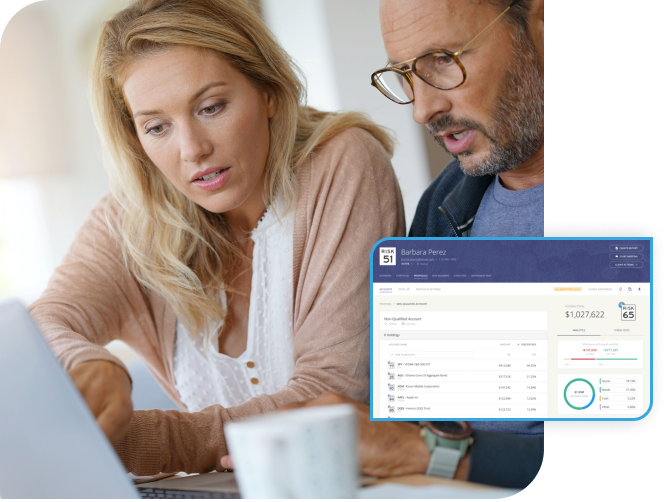

We believe that technology is key to delivering solutions that are highly specific to each client’s’ financial landscape and goals. getting a full picture of assets and liabilities and investments working together.

Running scenarios of changes to your portfolio allocations allows us to see the ripple effects of changes in strategy we consider for you before we make any moves in your portfolio.

Before we can come up with a plan, we need to understand what we are working with. The Asset Map takes you step by step through all your assets, even some you never considered as part of your financial landscape. Your liabilities get examined as well; you may discover some can actually be assets when expertly managed.

When it comes to financial planning, do you know what the difference is between your needs, wants and wishes? What category do each of your goals fall into? Money Guide Pro walks you through that decision-making process and facilitates those hard conversations you will need to have with your loved ones and yourself.

Financial advisory is not about investing with gut feelings. It is about evaluating risk against timelines, and desired cashflow. Nitrogen laying out and aligning your risk tolerance and the risk profile of your portfolio.

You'll get updates and actionable info straight to your inbox!