Many people feel that wealth equates to a worry-free life for themselves and their loved ones. People with wealth know that is not always true. We understand that wealth without planning can lead to a nest egg disappearing quickly.

We specialize in serving individuals and multi-generational families who seek ongoing counsel on a variety of subjects as they navigate through the different stages of their lives. Our Private Wealth clients are high net worth households who are sound financially but know there are potential pitfalls in retirement and major changes in life, and the impact their absence would have on their loved ones. They turn to us to ensure they and their loved ones are taken care of going forward.

We take a holistic approach to wealth management. It is not just about where you are and what you are doing now; it is about where you need to be in the future so that you and your loved ones can be doing the things you want to do now and in the future. Our clients are like family, and we treat them as such.

Knowing our Private Wealth clients beyond their current portfolios is key to our process. Understanding past decisions, current thoughts, and forward-looking desires, gives us the puzzle pieces to put together a portfolio that grows and protects wealth within your risk tolerance boundaries. As a Private Wealth client, all Advisor 360 services are included as part of your personal planning.

Advisors360 LLC is an independent wealth management firm specializing in providing highly proactive financial planning and investment management to our clients. Focused on our fiduciary responsibilities, we act in the best interests of our clients in all our decision making, without bias toward any financial product or investment company.

Due to our independence, we have been able to leverage teams at several institutions and boutique investment firms, to deliver multi-manager, multi-strategy solutions, tailored to each client.

Through decades of financial advisory experience, we know that one of the essential factors in a successful outcome for clients is the level of trust and understanding between client and advisor built over time. We are as picky about the clients we take on as you should be about who manages your money. Let’s start a conversation to explore if we are right for each other.

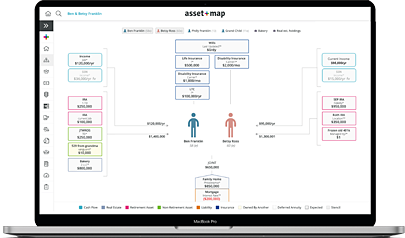

Our financial advisory services start with an Asset Map, because understanding the full scope of a client’s financial life and their personal life will drive the portfolio creation process.

We know our clients need more than a great portfolio. We have designed our services to touch major areas of wealth generation, preservation, estate planning and lifetime gifting and allocation.

Private Wealth Management Services are reserved for clients with investable assets of $500,000+ that are managed by the firm.

Clients are billed a percentage of assets under management.

$500,000 to $999,999

1.50%

$1,000,000 to $2,499,999

1.25%

$2,500,000 – $2,999,999

1.15%

$3,000,000 – $4,999,999

1.00%

5M+ = Determined at engagement

Example: A client with $1,000,000 in investment assets managed by the firm will be charged a 1.25% annual fee. At the end of each month a calculation is done on the closing balance and 1/12 of the 1% is billed. If a client had a $1,000,000 balance they would be charged and advisory fee that month of $1,041.67.

*Advisory fees are negotiable.

You'll get updates and actionable info straight to your inbox!